This is exactly eg great for young couples only starting you to definitely have access to family-owned homes

- Start conservatively.Inside the deciding the cost of your home, begin by the fundamental family size and you can floors plan with little to no or no facilities. You will need to tend to be charges for basics for example it allows, inspections, power availableness and you will hookups, sewer program hookups or septic container setting up, water wells and you will gasoline otherwise natural gas installation if necessary.

This is certainly such as helpful for young couples just getting started you to have access to family-owned land

- Do a wish list.Involve some tip what type of has you would want to keeps for the target domestic. Based can cost you, your enities including pavements or a garage on the financial to-be paid off more a long period of your energy. However you enities for example a rear platform, stores buildings or workshops after, after you have gone inside the so that as your bank account allows. Other features you should thought was upgrades during the carpet, appliances, additional service or fixtures. Such improvements, once you get your new home, will definitely cost lower than modifying them out later. Zero feel inside buying best personal loans in Chicago them twice.

This is certainly instance great for young couples simply starting out one to have access to family-owned land

- Focus on the features.After compiling the menu of family keeps which can be important to your, focus on them. This may push you to be able to make tradeoffs later on on the, if required, once you have based your allowance. And additionally, this information would-be quite useful to the homes representative. They can make it easier to prioritize and might consider most items you might not have experienced eg fireplaces otherwise built-within the specialty cupboards. Many items are packaged for lots more offers.

This might be including great for young families merely getting started one get access to family-owned belongings

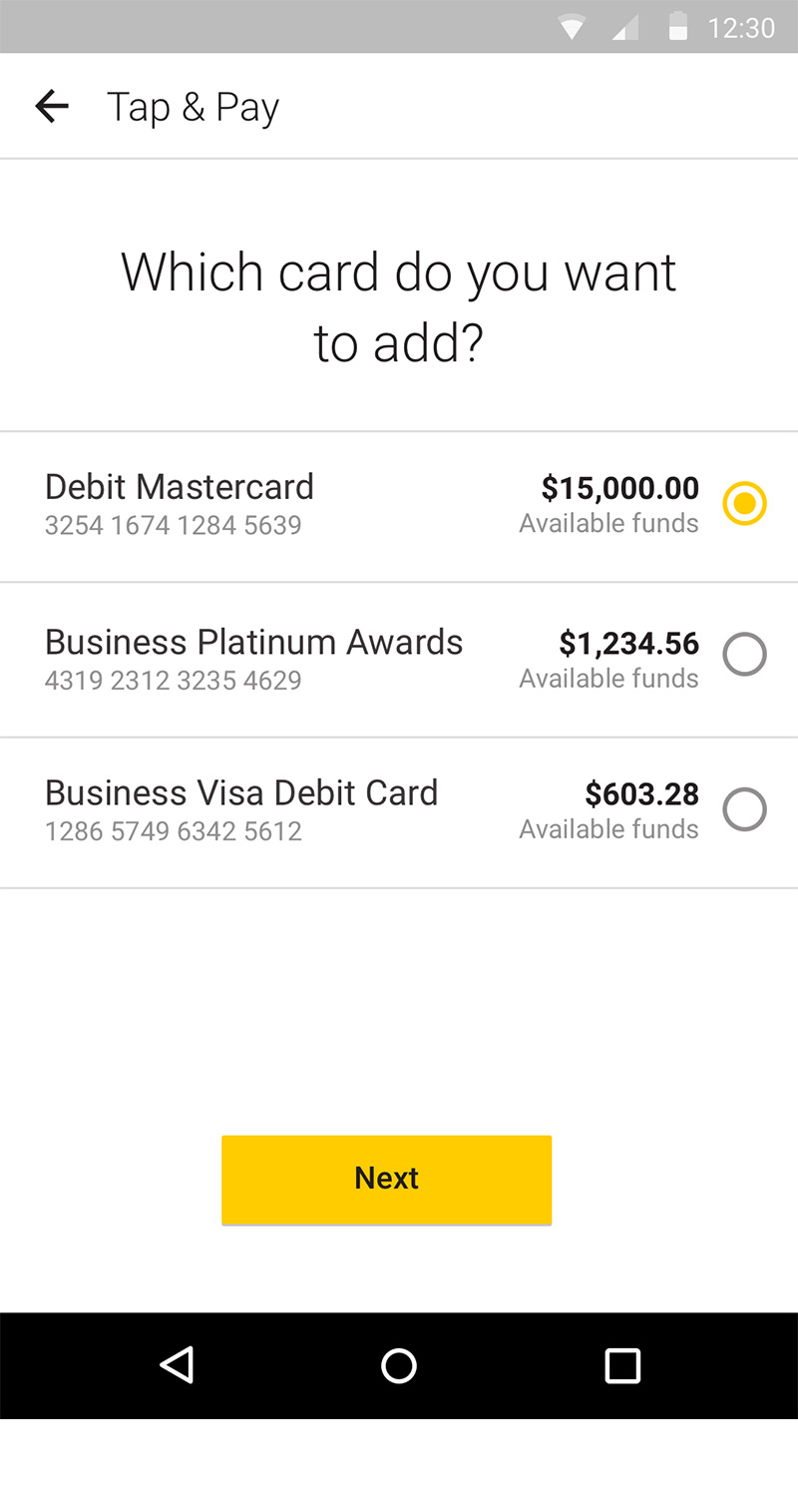

- Peg your advance payment.You could start out by reacting a couple of questions like…

Exactly how much would I’ve designed for a deposit? Understanding this type of solutions helps you understand what brand of funds you can buy. Typically, down payments start around 5 20% from a great home’s cost. With a few registered lenders, if you own your house outright or have a great number of equity, you are able to qualify for zero downpayment.

That is including ideal for young couples just getting started you to definitely have access to family-owned house

- Do a little math.The standard rule having monthly mortgage repayments is that it should become anywhere between twenty-five so you can 33 per cent of monthly revenues. Way more specifically, this is the code, a helpful product to own mortgage cost: Use a down-payment out-of 20% and no more twenty eight per cent of your gross annual money is going in order to mortgage, insurance policies, homeowner’s fees and you may a house taxation. Just about thirty-six percent of disgusting yearly income is see financial, family and other financial obligation expenditures like credit debt, vehicle and college or university financing, an such like. *Observe that the very last a couple number, in this case, twenty-eight and you will 36, depict loans-to-earnings ratios, and help your determine your own limit month-to-month mortgage repayment. Standards change with regards to the financial segments and you may political influence on the brand new financial world. With the mortgage calculator significantly more than would be to assistance with these numbers, but dealing with one of the people could be the ideal way to get a very clear image of what realy works for you.

This is such ideal for young couples only starting one to gain access to family-owned land

- Rating prequalified for a financial loan.As we mentioned before, doing work using your funds provides you with a great opportunity to feedback your bank account having that loan elite and you will truly determine if your house purchasing plan are possible. This step does not prices one thing and ought to leave you an excellent idea of how good you happen to be standing is as an excellent homebuyer in the which market as bank will cautiously take a look at your money to possess you to prequalification.

It is such great for young couples just getting started you to gain access to family-owned land

- Correspond with family and friends.Keep in touch with leading household members and you may loved ones which are able to offer you particular opinions, type in if you don’t advice on buying or strengthening a separate household. About, they may be a sounding board your suggestions you can also enjoys. This is just another way to get a special position to the some thing, especially regarding the significant decision which is facing your.