Assemble the fresh new comments the expenses and you may fund you have to pay down and you will very carefully review the interest rates and you may conditions. These could were: – auto loans – boat/Camper financing – playing cards – unsecured loans – other domestic equity funds otherwise lines of credit – most other highest-attract loans Just like the a kick off point, you’ll want to recognize how far your debt on each debt, the rate / Annual percentage rate you might be spending, and you can that which you usually shell out. The debt consolidation calculator will help you to decide Chase installment loans your total debt, the length of time it will require to pay it well, as well as how far possible pay for individuals who keep your current movement, and potential savings available to choose from having a debt negotiation.

There are couple limits on the best way to you utilize new lump sum commission from your own cash-out refinance mortgage. Borrowers have properly made use of that it loan so you’re able to combine loans, build fixes or home improvements to their household, otherwise help instructional costs. Evaluate your loan choice making a choice according to the financial means.

So why do somebody refinance their home mortgage loan?

Refinancing your residence mortgage enables you to pay off your modern home loan with a brand new loan. Generally, anyone re-finance their original mortgage for starters or higher explanations:

- to earn a better rate of interest,

- to convert a variable rate so you’re able to a predetermined price (otherwise vice-versa),

- to minimize monthly obligations from the extending the brand new cost term of your own mortgage , or

- to minimize notice costs repaid along the lifetime of the mortgage by detatching the installment identity of your mortgage.

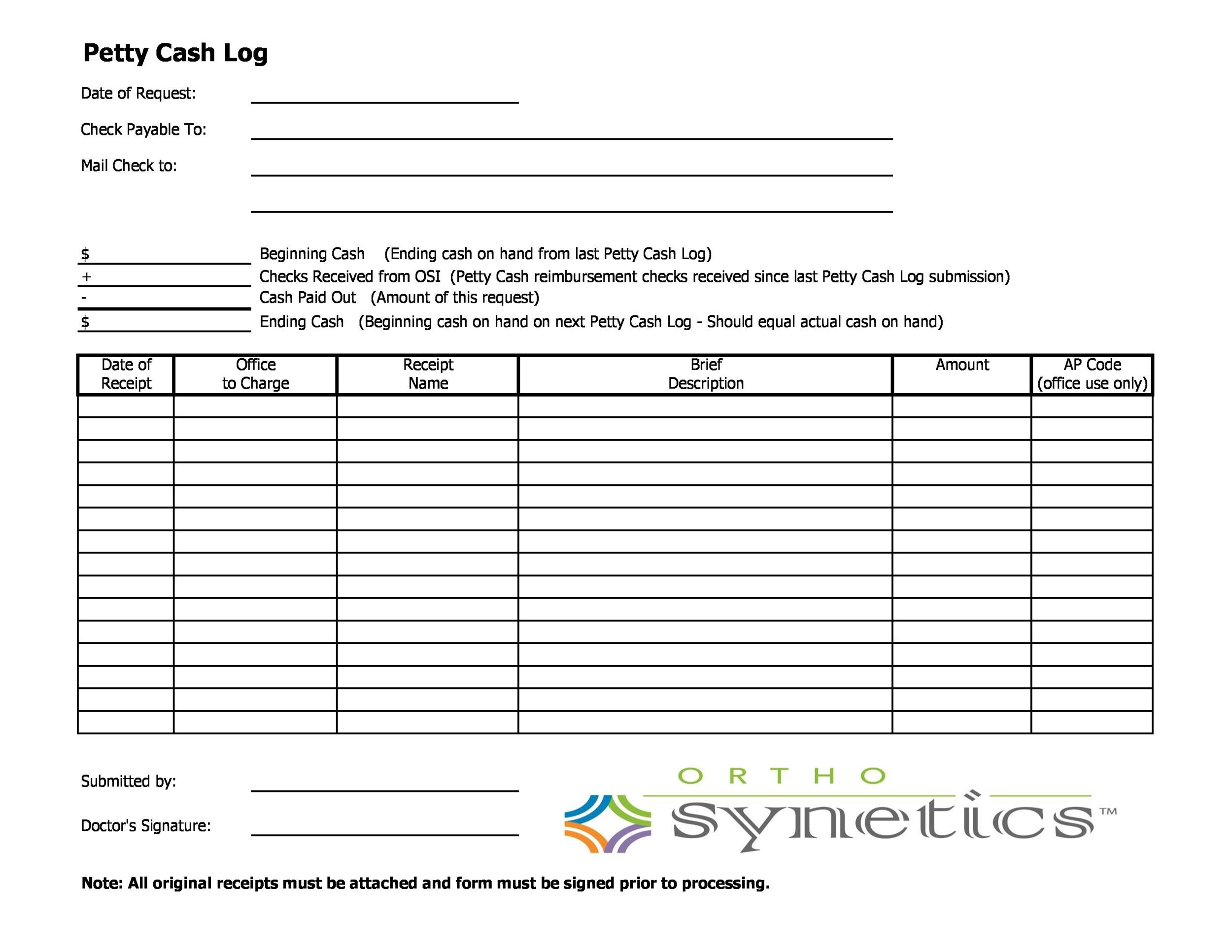

- Origination

- Paperwork

- Account Administration

Just what homeowner’s insurance policies conditions will i need to fulfill in the closure?

During the time of closing, loan providers require that you demonstrate that you have sufficient insurance rates when you look at the put. Particularly, while you are to get property, your lender may require insurance rates that is valid for just one year and talks about at the very least 80% of your substitute for worth of your residence. Whether or not bank rules vary, you can also thought to shop for complete substitute for can cost you insurance policies also whether your bank doesn’t require they, to make sure that you could potentially fix otherwise rebuild your home just after a fire or other losses.

What is an escrow membership?

A keen escrow account is typically founded in the course of the closure. An escrow account try held of the lender and has money built-up as part of mortgage payments getting yearly expenses such as fees and you can insurance.

Can be Come across Home loans spend my creditors really to your continues out of my personal financing?

Sure. We know that after you have made your residence equity loan or home loan re-finance, the prospect regarding contacting your creditors and you can composing personal monitors so you can for each feels a tiny challenging. Together with your consent, within your loan purchase, See Lenders would be happy to deal with that it for you at the no additional rates if you are paying your creditors privately and you can delivering people leftover finance to you.

Exactly what data files should i apply?

We’re going to offer you an initial a number of data files we want to get started. All of the financing varies, therefore we can get consult more records as we move through the financing procedure. Here are a few our very own Application Checklist for more information.

Do i need to fill out data on the web into the software process?

Yes. You can submit your posts online within secure web site: DiscoverHomeLoans/Sign on. Entry data on line will help automate the new processing of your loan consult. Our very own safe website in addition to allows you to glance at your loan position, check your To-do Number, feedback the new reputation of delivered data, and more!

Can i would my membership on the internet?

Sure. As soon as your mortgage funds is actually disbursed, we are going to upload a welcome letter that has had their permanent financing count and teaches you just how to setup your brand-new on the web membership. Together with your on the web membership, possible examine comments, would repayments, install email notifications, rating tax documents, and much more.