Check out our very own guide to swimming pool money and you may learn your own alternatives for cracking floor towards the pond you dream about!

What does a forever house extremely feel like, and you can what’s forgotten? However some homeowners envision which is a home otherwise toilet revise, anybody else look at the grass and you will consider learning to make the quintessential of your outdoor space. Which could mean incorporating an enthusiastic ADU or including a tiny deluxe particularly a keen inground pool. Contained in this book, we are going to help you to see the various methods you can loans a pool and you may plunge deep on positives and negatives from for each and every.

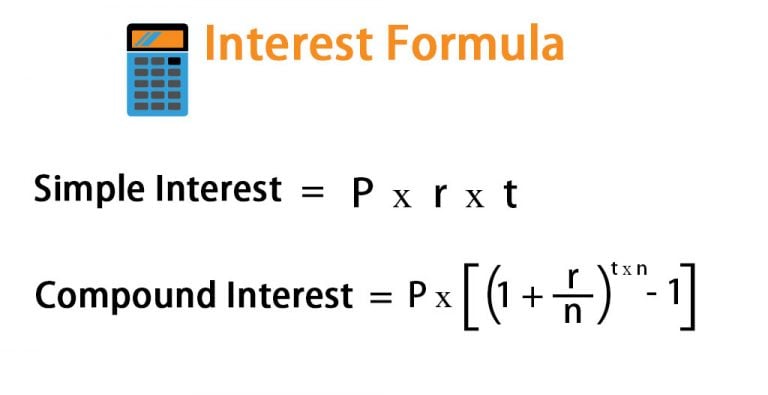

Given that most property owners can expect to invest more than $50k, choosing the method you to allows you to acquire the money you prefer into the lowest you’ll be able to monthly obligations is important.

We are going to familiarizes you with RenoFi Loans, a different sorts of home repair financing you to enables you to obtain according to research by the coming value of your residence adopting the framework of the pool has been complete, or take advantageous asset of business prices, instead of the high rates of numerous solutions.

We are here so you’re able to money the building of the swimming pool because the affordably that one may and discover the fresh new constraints away from old-fashioned family security money and you may personal lines of credit, an earnings-out refinance, or any other methods of pond resource.

Best ways to Money A share

Less than we’re going to should expose you payday loans Oronoque to RenoFi Money and help you to definitely understand this they’ve been perfect for people citizen. We’re going to compare all of them with conventional selection; property collateral financing otherwise line of credit, a funds-aside refinance, build mortgage, a good HomeStyle financing or an unsecured personal bank loan.

RenoFi Mortgage

Good RenoFi Mortgage enables you to obtain the cash which you need certainly to would home improvements or additions (in this case, the development regarding a keen inground pool) according to your residence’s coming worthy of. It’s a second mortgage which is very well suited to these investment.

While using the equity possess traditionally come the new go-so you’re able to cure for money improvements or enhancements to your house, it’s got its constraints. And most homeowners will get you to their borrowing stamina is bound.

Envision you merely has just ordered your home. And when i state recently, that which we extremely indicate is within the history four so you can ten decades.

Brand new severe the reality is which you have perhaps not accumulated sufficient collateral to cover your pond, based on how ages it entails:

However, a great RenoFi Loan allows you to acquire in accordance with the really worth in your home once your pool has been strung. And because it deluxe introduction often definitely raise exactly what your residence is really worth, it is gonna improve your borrowing from the bank electricity.

This means you can obtain the money you pay to suit your pond without the need to discover a means to reduce the prices or go for an alternative with high rates of interest and you can, next, who does mean high monthly premiums.

An effective RenoFi Loan might possibly be a terrific way to funds their pond endeavor. The latest RenoFi Mortgage process renders financial support easy!

Reasons Not to Play with Conventional Solutions

Guess you have got sufficient tappable guarantee in your home. In that case, a property security financing or household collateral credit line (HELOC) might possibly be a choice for that used to financing the design of one’s inground pond. However,, as you read more than, unless of course you lived-in your house for decades, there can be a good chance that will never be the case. You no longer need to attend up to you may have enough security offered when you can borrow against your residence’s future well worth alternatively.