The home loan might be the greatest investment decision your actually ever have. The brand new Independent stated during the 2016 that average Uk mortgage stood at ?117,162; when taking away a separate financial it is vital that you will be making the proper choice for your requirements.

How much ought i use?

All mortgage lender has different methods where you work aside just how much they lend. Some lenders fool around with income multiples to determine your borrowing from the bank capability if you’re others play with state-of-the-art affordability-oriented calculations.

The way that mortgage brokers deal with one present borrowing from the bank responsibilities and additionally differs from financial to help you lender. Learn how your credit score was calculated right here.

Very, speak to your mortgage agent and make sure they are aware of one’s private facts, such as your income and you can outgoings. In that way they shall be able to give you a clearer idea of how much you could obtain.

What documents will you need?

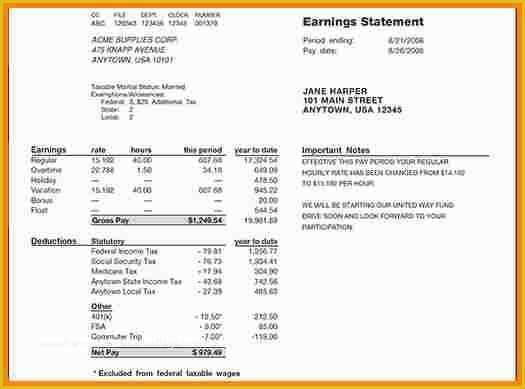

Financial institutions and building societies need to see proof of your revenue, while the, you’re going to have to satisfy money laundering rules from the appearing their title.

While employed, you will definitely have to bring shell out slips and you can a great P60, while you are while you are notice-functioning, you will likely need certainly to produce tax statements or account.

Ask your lender what they’ll you would like away from you thus you can get most of the files you will you prefer.

What kinds of mortgages do you really offer?

There are numerous variety of mortgages. Most the new mortgages are advanced on a repayment’ foundation, in which your own payment per month consists of particular interest and many of the quantity you owe.

Specific mortgage lenders bring attention only’ mortgages while some provide specialist income such as for example counterbalance or newest account mortgage loans. Discover what choices you’ve got when talking with your adviser to ensure you’ll end up advised what’s best for you.

Just what rate of interest choice do We have?

During the , Moneyfacts reported that there are cuatro,460 home loan marketing found in great britain. With so far choices, it is important that you ask your financial just what issues he has got readily available.

- Repaired rates which promises your instalments getting a specific several months, meaning your payments would not rise (otherwise fall) for a fixed several months.

- Ft rates tracker this implies that the mortgage music the bank out of The united kingdomt Base price. Should your Ft price change, their financial rate might change.

- Discount variable price it also provides a benefit out of your lender’s Standard Changeable Price (SVR). It does usually rise and you will fall once the interest rates alter, however, since mortgage lenders manage its SVRs, it will increase otherwise fall less than simply standard rates.

What arrangement costs do I have to pay?

Really mortgages include specific lay-right up commission. Actually, the typical plan payment to the a predetermined price package today stands on ?1,018.

Also an excellent tool fee’ you’ll be able to have to pay other fees to help you their mortgage lender. These can are booking costs, valuation charges and other arrangement charge. Definitely know what charges apply.

Whenever trying to get a home it is critical to know that you can need to put a deposit to the home, this is usually a lump sum once the a share of your own cost of our house

A beneficial 5% deposit ‘s the standard minimum payment needed in great britain. Yet not, an average try ranging from ten% and 15%, the greater the fresh put you put down, the reduced the attention costs is https://paydayloanalabama.com/nanafalia/ on your own mortgage.

Just what valuation options are readily available?

When you take aside an alternative financial, their bank will require an experienced surveyor to value the property. You normally have a choice when it comes to the sort of valuation you want:

- Earliest valuation which find the worth of the house or property that will emphasize one extreme faults.

- Homeowners survey and you can valuation this includes advice on conditions that make a difference to the worth of the property and necessary solutions and ongoing repair.

- Building/architectural survey a thorough questionnaire with information regarding flaws and you may fix and you will repair alternatives.

The kind of valuation you choose is based on things such as for instance due to the fact chronilogical age of the property, the shape and you will whether or not there are situations you would like new surveyor to check on. The expense of the fresh questionnaire hinges on the value of the house therefore the level of valuation you choose.

Exactly what are the early cost fees?

By taking aside an alternate product along with your lender a fixed, discounted or tracker rates contract you will find a go that the package may come that have early installment charges’. These are costs your levied for people who pay straight back certain otherwise all home loan contained in this a specified months.

Eg, by firmly taking a-two season repaired rates price, you can face an earlier fees charge of five% for individuals who pay the borrowed funds within the 24 months. However, so it hinges on the latest regards to the deal that you was necessary.

Ought i overpay?

Even though many mortgage product sales come with very early fees charges, very enables you to overpay by the a small amount. Of a lot loan providers allows you to repay doing ten% of your own the balance on a yearly basis instead taking on people charge.

If you are planning to overpay, ask your bank should this be you’ll be able to. It’s also wise to mention exactly how their overpayments would be treated and you may whether or not they be removed their mortgage harmony straight away.

The length of time does it shot process my personal software?

If you are promoting a home to acquire another property, you will be doing work in a string; Instead, or you could have to circulate easily. Very, its smart to evaluate along with your mortgage lender just how long they needs them to process your home loan app.

Numbers regarding National Relationship from Auctions show that the newest mediocre day it takes in order to secure a mortgage possess risen from up to 37 days so you can 53 weeks because 2014. That? reporting one 13% from possessions revenue fall due to since the techniques takes a long time, it’s important that your particular bank can change around the job in order to the timescale.

Carry out I must remove any insurance coverage?

Your lender tend to demand you sign up for buildings insurance rates for the your home, however, ask whether it’s are with them or if or not you could take your insurance policies someplace else. Your own financial may charge you for taking your property insurance policies with an alternative supplier.

If you’re making an application for a mortgage, this type of ten inquiries can help you to make sure you learn and are prepared for what might be the biggest investment decision regarding yourself.