- FHA Loan Limits: Referring to the usa Agency off Houses and you will Urban Creativity the newest limit amount you could potentially obtain relies on the cost of homes from inside the a certain town. To possess discount elements brand new restrict are $420,680 and for high pricing section the new restrict was $970,8000. It may differ from the county and you will state.

- Domestic Explore: FHA finance are just applicable to own qualities and will not end up being granted to financing or trips attributes.

- FHA Assessment: In advance of qualifying getting an FHA financing an enthusiastic FHA appraiser usually measure the property according to a couple of protection direction.

There can be way more requirements which might be extra by the loan providers into the greatest ones required for a keen FHA financing, it’s important to check with numerous lenders to determine what lender will be your top match.

Va Funds | 580-620

As Virtual assistant claims their funds up against loss, lenders render Va money from the suprisingly low-interest rates, usually these represent the reasonable rate of interest funds available.

Va money along with don’t need a deposit which means mortgage might be 100% of the property speed. In acquisition to track down a Virtual assistant home loan a certification away from Qualifications (COE) is needed.

USDA Funds | 620-640

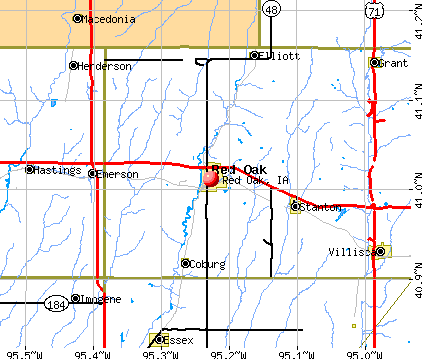

USDA mortgages are offered for residential property outside of heavily inhabited areas of the united states. Even though, USDA fund are nevertheless relevant to around 90% of your end in the united states.

This includes outlying portion, quick cities, and many suburbs, however, exceptions can be made to possess homebuyers with extenuating factors. USDA money like Va financing do not require a downpayment, and on average the eye pricing would be 0.5% below old-fashioned funds at a time.

Jumbo Funds | 700+

Jumbo fund is actually for homebuyers whoever mortgages are way too highest for the regional home loan restrict. There’s absolutely no specific credit rating dependence on an effective jumbo home loan, but highest results are more likely to be recognized.

Really loan providers require a credit score away from 700+ to be qualified. Va Jumbo fund may be available at credit scores of 640 and a lot more than. In order to be assigned a lower life expectancy interest rate it is preferable so you’re able to count on trying to find a score regarding 700+ variety.

Jumbo finance can be used for a variety of assets items, and also have been useful number 1 residences, including relaxation characteristics including vacation property, or characteristics you to serve as a financial investment.

In the modern economic climate it. will probably be that you look for yourself falling lacking the required borrowing or Fico get necessary for a mortgage. Yet not all the is not lost, you might bad credit installment loans Illinois go after particular advice that will description ideas on how to has the credit buying a house.

As a result of after the a number of basic steps you could replace your borrowing from the bank get of the quite a lot into the a brief period of energy. A couple of things which will help change your credit score is: preserving your stability to your playing cards reasonable (under 29%), paying all of your debts on time, and you may starting the brand new profile that can statement beneficially to the borrowing bureaus.

Following this it is very important allow your of use accounts adult into the a good position, which have a lot of time history of timely percentage background and in charge use can get your credit score improving in no time.

- Loans so you’re able to Money Proportion (DTI): So you can determine DTI seem sensible all of your current month-to-month loans money and you can divide the entire by the gross amount of income you have made per month and you can multiply it by 100 to possess a percentage. To help you qualify your DTI should not be any bigger than 50% that have a perfect in the fresh forty%-45% range.