- Business has been in existence for a long period: The credit Expert would be honoring their 3rd -a lot longer background than simply most other borrowing fix businesses.

Disadvantages Said

- Expensive: The financing Guru charge a much higher minimum basic-work payment ($149) and ongoing monthly fee ($89) than simply almost every other borrowing fix enterprises.

- Helps make specific iffy states: The firm claims to bring credit card debt relief qualities, something which of many regulators consumer security groups warn up against. It will make some not true says regarding how credit agencies glance at disputes originating from borrowing resolve bureaus as more legitimate than for many who were to do the ditto your self, and will be offering in order to dispute all of the negative information on your own credit history in the hopes of setting it up removed (anything it can’t perform).

- Dated, clunky webpages: A portion of the page advertises a «the latest credit scoring model» moving in 2017, such as for example, and there’s no customer portal you need to use to help you sign in to expend-you enter the credit card suggestions directly into a type toward its site. The site is even riddled having typos.

- Buyers feedback try strangely scarce: Unlike other borrowing from the bank resolve enterprises, you will not select studies into Borrowing Master for the Trustpilot, Yahoo, and/or Better business bureau. Instead, there clearly was simply a great smattering regarding evaluations to the Yelp.

Particular Properties

The financing Guru isn’t most initial regarding the information on new qualities it provides-things you will need to suss in the fresh totally free demand in the event the you are doing contact the organization. But this is the gist from exactly what it offers.

Professional Borrowing Research

When you get The financing Expert, a credit analyst usually schedule a phone call to discuss your own credit reports along with you. Together, you’ll be able to get a hold of any wrong suggestions, if in case one is positioned, which will be the new springboard towards real borrowing from the bank repair process.

The financing Master proposes to argument «all bad and you can/otherwise wrong information,» but if you has actually bad information on your file plus it really is best, The financing Expert is not supposed to do this. You can only clean out bad suggestions in case it is inaccurate, even though borrowing repair no credit check loans in Norwood CO businesses will get you will need to treat perfect negative guidance having goodwill requests.

Borrowing from the bank Problems

In accordance with the pointers new analysts about Borrowing Master select, they’re going to interest and send-off dispute letters to get the incorrect pointers taken off the credit file. To take action, might require that you indication a finite electricity regarding attorney so you can focus on the part.

Right here happens the region: You have got to agree to give people telecommunications you receive of creditors or even the credit agencies straight to The credit Guru. Within the terms of the latest offer, you’re not allowed to contact these people your self. You might be together with responsible for keeping track of just how long tickets from the time brand new letters try sent, and you ought to allow Borrowing Master determine if forty weeks admission without hearing an answer straight back.

If you cannot would those things, then the Borrowing Expert states youre in the course of time one «guilty of any lack of advances in the disputing techniques.»

Business Has

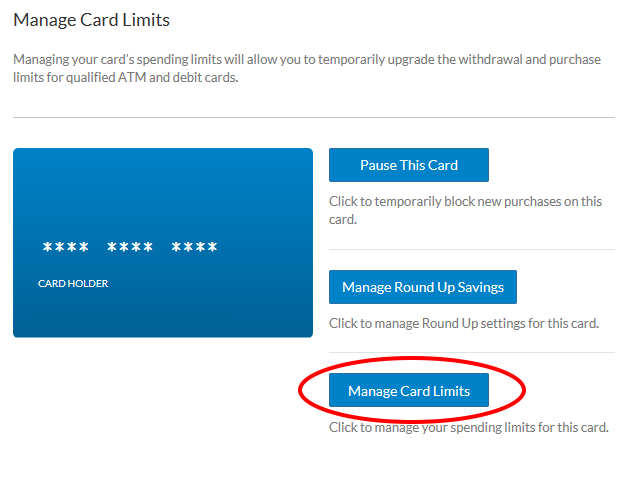

The business has no a software, a live talk assistance feature, an internet customers site, a card overseeing services, a loans government system, or anything and just what we currently discussed. The credit Expert will not need a right up-to-big date, expertly designed website.

Customer service

You could potentially come to customer support in the Borrowing Guru of the emailing or calling (888) 528-6041. The company would depend in Edmonds, WA, so it likely works into Pacific Date, although it does perhaps not indicate its regular business hours.