The brand new Va mortgage is among the best ways for a qualifying veteran, service affiliate, otherwise thriving partner regarding a help member to find a property. The point that capable get property instead of a down payment is very good alone, but when you combine another professionals such as for example lowest-rates of interest and no private home loan insurance charges, this is exactly an effective home loan for our veterans. And make this option flexible, there was a great Va improve refinance (Virtual assistant IRRRL) alternative which may be accomplished in place of an assessment.

The brand new Virtual assistant Streamline Re-finance Choice

With regards to the Va assistance, there clearly was a streamline re-finance program entitled mortgage loan Reduction Home mortgage refinance loan, aka IRRRL. Some lenders range re-finance interchangeably. This is a loan which can be found just to people who actually have a beneficial Va financial. The only real purpose of the mortgage is always to reduce steadily the borrower’s rate of interest, and so protecting all of them money over the period of the borrowed funds.

Loan Processes is much simpler

For anybody who has done home financing, whether to own a purchase otherwise an effective re-finance, you know there is plenty of files on it. The lending company will take the amount of time to examine your income and you can property immediately after which acquisition an assessment.

- Consumers commonly needed to show evidence of their current money

- Borrowers need-not disclose people possessions particularly savings accounts, advancing years membership, inventory investments or other drinking water holdings

- Another type of assessment is not required

- The fresh closing costs which can be regarding the improve re-finance can also be be included in the new amount borrowed

- Certain time improvements is going to be additional on the amount borrowed

The new reduction in paperwork and requirements makes that it financing a much smoother processes. Generally speaking, an excellent Va improve refinance mortgage commonly close-in a much reduced time period than just a normal pick mortgage.

Utilizing new Va Improve Refinance Choice

Precisely why people utilize the Virtual assistant streamline re-finance try to take advantage of down interest levels. Home loan costs go through cycles, and more than anyone want to get a minimal rates you can. If the period out of rates falls interest levels somewhat less than exactly what the fresh new borrower got to start with, it’s wise to help you refinance.

- Change from financing with a changeable-price so you’re able to a predetermined rates

- Alter the title (all the way down regarding 3 decades to help you a smaller-term)

- Money the expense of developing a home more energy saving

We have found an extra bonus. When the a homeowner having a current Va home loan is during an enthusiastic city where in actuality the possessions philosophy have remaining off, they are able to still utilize the Improve Refinance to lessen the interest rate. Since the another type of assessment isn’t needed, it does not matter should your home’s value is less than the current market price.

Earliest Va Improve Refinance Conditions

- Must have current Virtual assistant home loan this choice is only offered to an individual who currently have a great Virtual assistant home loan. When you’re there are many version of refinances available for people who have a beneficial USDA, FHA, Federal national mortgage association or Freddie Mac mortgage, this specific financing isnt accessible to all of them.

Faqs In regards to the Va Improve Re-finance

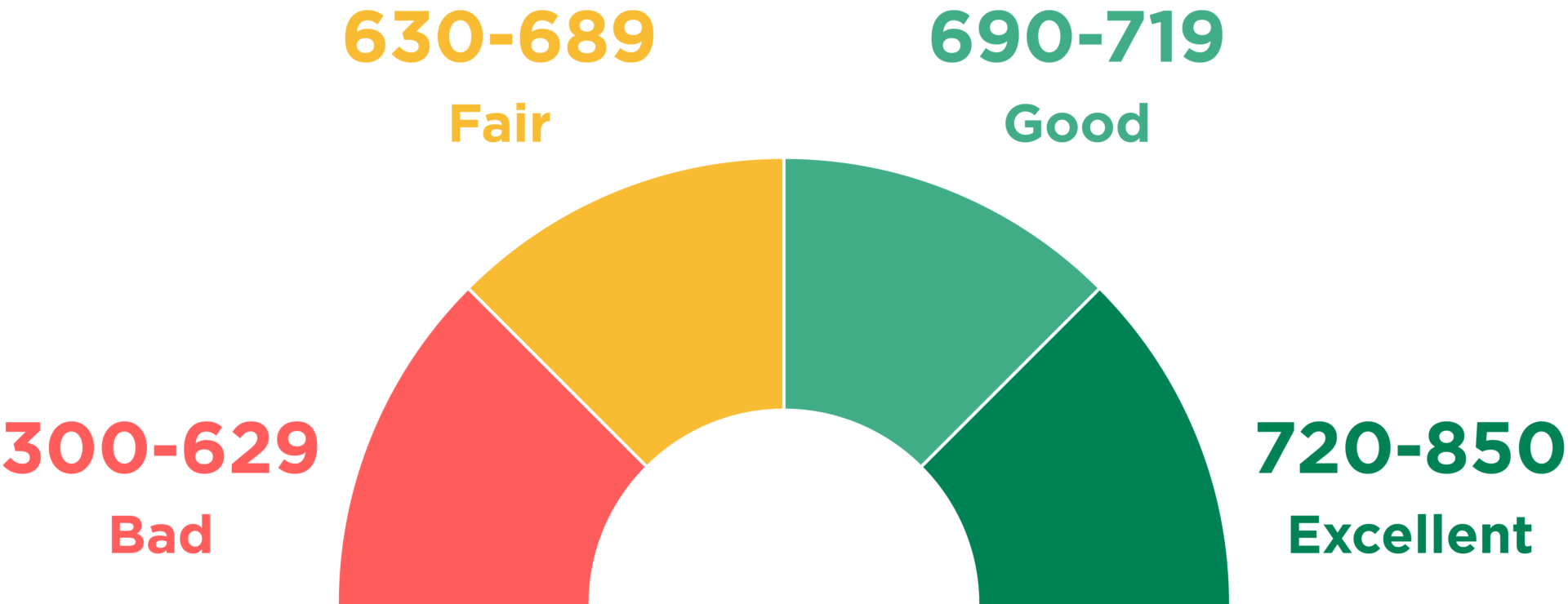

Just what credit history required? Lenders will have their particular requirements to have credit ratings. It’s always best to keep in touch with a lender familiar with Virtual assistant Improve Refinances to discover their certain borrowing direction.

Is actually a different sort of identity insurance rates binder important for this new refinance? Sure. And if one buys or refinances personal loans online Missouri a home, a different sort of label insurance binder is actually expected. The fresh new binder will bring proof there are zero a fantastic judgments otherwise liens that can features an awful effect on the mortgage.

Was We needed to utilize the exact same lender towards re-finance you to definitely given the original pick financing? Zero. You are allowed to use one financial that is acknowledged in order to render Va home loans on your own county.

Are I required to request a new certificate from qualification (COE)? The existing Va home loan signifies that you have a legitimate COE. Thus, a unique COE are not requisite.

Can i have the ability to change the individuals on the loan? The brand new experienced that in the first place qualified for the loan, plus one co-borrowers, should stay on the latest Virtual assistant improve re-finance. When it is needed seriously to remove otherwise include a co-borrower throughout the financial, delight consult with your financial about another kind of refinance financing.

Try individuals permitted to forget money on the streamline re-finance? No. Dont end and work out repayments into the established home loan. You would not be bypassing people costs.

Some people that have got good Va financial for a while could well be best if you browse the a choice of providing an effective Va improve refinance mortgage. The newest typically lowest cost that exist at this time manage conserve very property owners a whole lot inside focus over the lifetime of the loan with no typical files for the a vintage refinance mortgage.